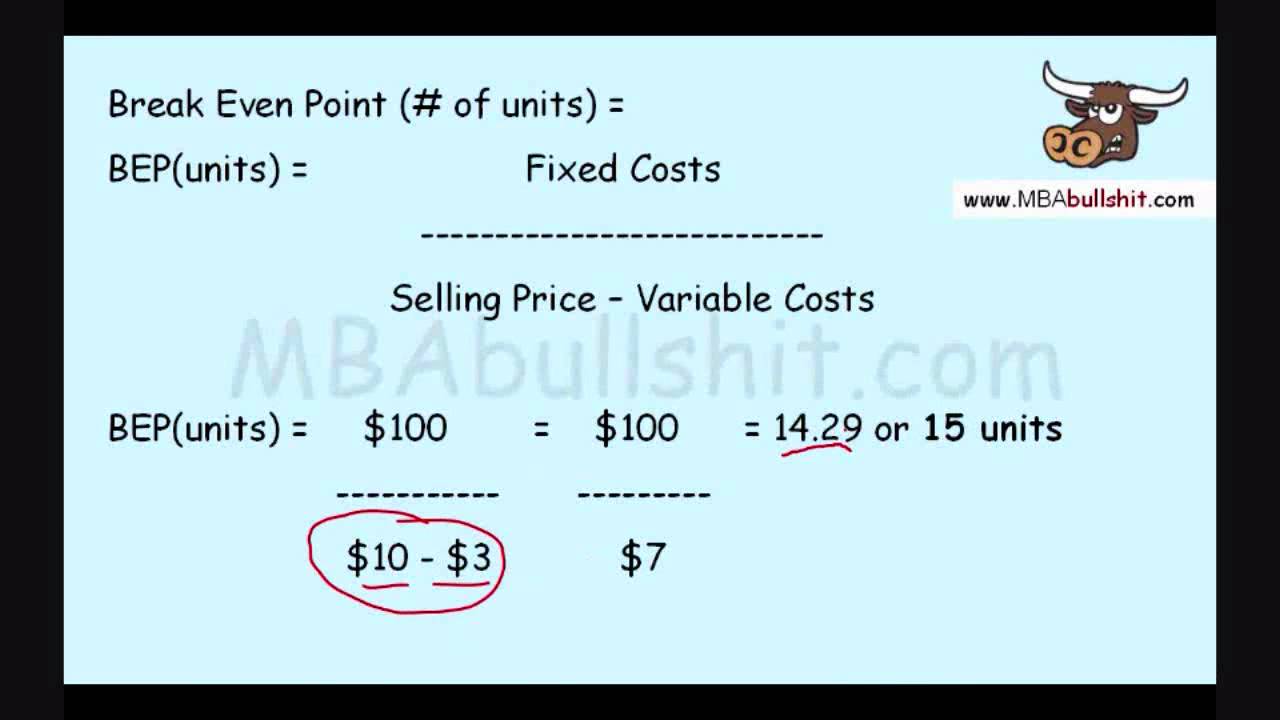

To turn that into a percentage, so you can use it in your break-even point formula. In this case, the business would need to sell 101 T-shirts to break even. The contribution margin per unit is 15 (40 - 25), so the contribution margin ratio would be 0.375: 15 / 40. In such cases, the business would always need to sell an additional item in order to break even. Sometimes the result is a little more complex, as the BEP may not be a whole number (eg 100.12). So this business breaks even when it sells 100 T-shirts. ExampleĪ business that sells T-shirts wants to find out what its BEP is. Hub Accounting JTo calculate the break-even point in units use the formula: Break-Even point (units) Fixed Costs (Sales price per unit Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) Fixed Costs Contribution Margin. The calculation in brackets, which gives the contribution per unit, must be completed first.

The result of this calculation is always how many products a business needs to sell in order to break even. You may also see this calculation written as:īreak-even output = Fixed costs ÷ (Selling price per unit− Variable costs per unit) Once the contribution per unit is found, the break-even output can be calculated:īreak-even output = Fixed costs ÷ Contribution per unit Firstly, a business must work out the contribution, this is calculated as:Ĭontribution per unit = Selling price per unit – Variable costs per unit This involves working out the contribution that each product sold provides towards the fixed costs of a business. Using break-even allows a business to understand its costs, revenue and potential profit to help inform business decisions.īreak-even can be calculated using the contribution method. The break-even level of output informs a business of how many products it needs to sell to reach the break-even point (BEP). Break-even is the point at which revenue and total costs are the same, meaning the business is making neither a profit nor a loss.

0 kommentar(er)

0 kommentar(er)