LOS 24 (e) Describe approaches for forecasting FCFF and FCFE. A forecast of after-tax operating margin or profit margin is required when forecasting FCFF by forecasting its components. A forecast sales growth rate is required when forecasting FCFF by forecasting its components.Ĭ is incorrect. The tax rate is not an input required when forecasting the FCFF, especially when an analyst already has the after-tax operating margin or profit margin.ī is incorrect.

#FREE CASH FLOW TO EQUITY FREE#

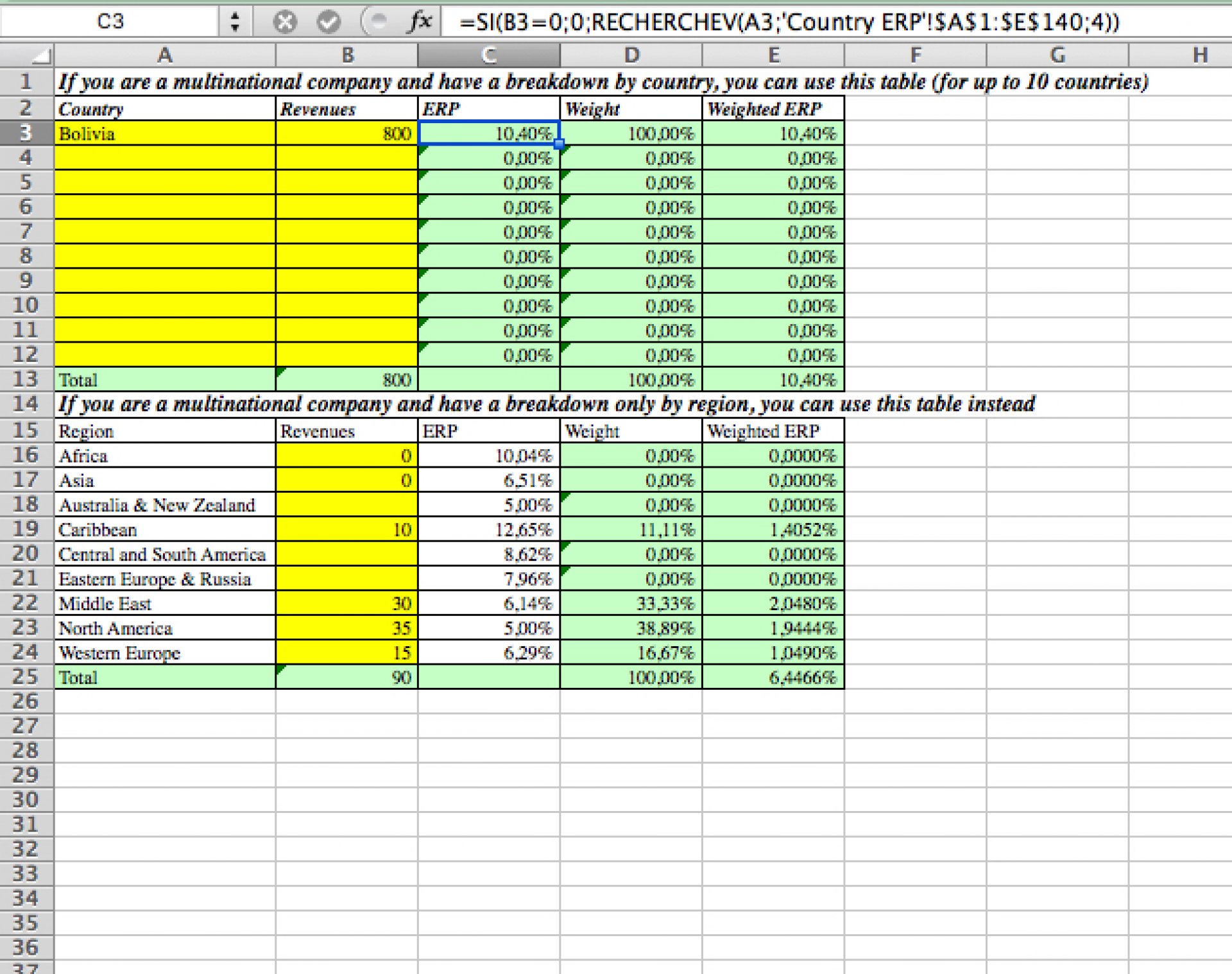

Forecasted after-tax operating margin or profit margin. Free cash flow (FCF) represents the cash a company is producing in excess of the cash it takes to maintain its core business and capital assets.Which of the following is least likely a required input when forecasting FCFF? Incremental fixed capital investments as a proportion of sales increases are computed as:.Incremental fixed capital investments and incremental working capital investments are estimated by multiplying their past proportion to sales increases by the projected sales increases. An estimate of the relationship between working capital investments and an increase in sales.įCFF is forecasted as EBIT (1−Tax rate) less incremental fixed capital investments and incremental working capital investments.An estimate of the relationship of incremental fixed capital investments and increase in sales.Forecasts of the after-tax operating margin or profit margin.If depreciation reflects the annual cost for maintaining the existing capital, the incremental fixed capital investments should be related to the capital expenditures required for growth.The debt ratio would then be the percentage of net new investments in fixed capital and working capital financed by debt. The debt ratio is also assumed to remain constant. Free Cash Flow to Equity is a discounted cash flow valuation method used to calculate a stocks fair value.Investments in fixed capital above depreciation (Fixed capital investments – Depreciation) and investments in working capital both bear a constant relationship to forecast increases in sales.Sales-Based Forecasting MethodĪ central assumption of the sales-based forecasting method is: This is a more complicated approach.ĮBITcan be forecasted by forecasting sales and a firm’s EBIT margin based on historical data and the current and expected economic environment.Ĭapital needs ( fixed capital investments and working capital investments) can be forecast based on the historical relationship between increases in sales and investments in fixed and working capital, both of which bear a relationship with a firm’s sales. Forecasting some components of free cash flow: These components are EBIT(1−Tax), net non-cash charges, fixed capital investments, working capital investments.It is calculated by subtracting the cash used for Capital Expenditure (CapEx) and working capital requirements from Cash Flow from Operations ( CFO ). This would be appropriate if the historical free cash flow has been growing at a constant rate, which is expected to continue in the future. Free cash flow ( FCF) is the cash flow a firm has remaining from its operating cash flows after accounting for its capital expenditure and working capital requirements. Applying a constant growth rate to the current free cash flow:This assumes the historical growth rate will apply to the future.Unlevered FCF is the more commonly used of the two."Ī screenshot below gives you a sneak peek of the template.There are two approaches used to forecast FCFF and FCFE:

Free cash flow comes in 2 forms, levered and unlevered.įree cash flow is extremely useful in LBO modeling as it shows how much cash the company will have to pay off the debt used to finance the buyout. "Free cash flow is a measure of how much money is available to investors through the operations of the business after accounting for expenses of the business such as taxes, operational expenses and capital expenditures. The template also includes other tabs for other elements of a financial model. The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. This template allows you to build your own company's free cash flow to equity model, which drives the final company valuation by discounting the effects of debt and creating an unlevered version.

#FREE CASH FLOW TO EQUITY DOWNLOAD#

Download WSO's free Free Cash Flow to Equity ( FCFE) model template below!

0 kommentar(er)

0 kommentar(er)